How to Save Money on Your Home Improvement Projects During Tax Season

Owning a home means qualifying for a number of tax breaks. In 2012, US homeowners claimed a total of $68.5 billion from the mortgage interest deduction. That works out to a tax savings of around $1,900 per homeowner, per year.

Although the mortgage interest deduction might be popular — about half of all homeowners claimed it in 2012 — it’s not the only tax break you can get from owning a home. Certain home improvement projects can help you save money on your taxes in the future, while a number qualify for immediate tax deductions or credits.

Are Home Repairs Tax Deductible?

Most home repairs aren’t tax deductible. If you purchase paint and supplies or hire a team of professional painters to give your walls a new coat of color, you can’t deduct the cost from your income on your tax return.

But some repairs count as capital improvements. While you can’t deduct the cost of these improvements from your current year’s income, you can add them to the amount you originally paid for the home. That’s known as your cost basis, or the original value of an asset used for tax reasons.

When you sell your home, you might have to pay a long-term capital gains tax on the profit from the sale. Your profit would be the amount you sell the home for, minus your cost basis. If you originally paid $150,000 for your home, then sell in five years later for $250,000, you made a $100,000 profit on the home.

If you improve your home in some way that adds to its value, such as a bath renovation that cost $10,000, your cost basis increases to $160,000, or $150,000 plus $10,000. When you sell the home for $250,000, your total profit ends up being $90,000.

If you live in your home for at least two years before you sell it, the IRS lets you exempt the first $250,000 of profit from the home if you are single or $500,000 if you are married and file a joint return. That might not matter much if the capital gains from the sale of your home are $100,000.

But if the original cost basis in your home is $200,000 and you sell the home years later for $500,000, making eligible capital improvements to your house can lead to a lower tax bill. For example, if you completed a kitchen and a bathroom renovation that cost $50,000, your cost basis would increase to $250,000, and your profit would drop to $250,000 — the upper exemption limit for a single person.

Now, instead of paying tax on $50,000 worth of capital gains, you have to pay tax on zero. When it comes to the amount you might owe in taxes, zero is always the better number.

Projects That Increase Your Home’s Cost Basis

Not every home improvement you make during tax season or for tax-saving reasons is going to ultimately help you save money. The IRS has some pretty strict rules about what counts as a home improvement and what’s just a home repair. The distinction is pretty clear.

A home repair — which doesn’t add to your cost basis — is an improvement that simply restores your home to its original condition. Applying a new coat of paint on a worn out wall or replacing a broken window are two examples of repairs that won’t increase your cost basis.

In contrast, replacing all the windows in your home with more energy efficient models counts as improvement. You can add the cost of that project to your home’s cost basis.

Another example of a repair that doesn’t add to the value of your home is fixing a leak in a bathroom sink. However, if you were to completely rip up all the plumbing and install new sinks, toilets and bathtubs, then it would count as an improvement.

There are a few exceptions to the list above. For example, if you install carpeting in your home, but then replace it years later with hardwood floors, you can’t add the cost of the new floors to your home’s cost basis. You also can’t add the cost of improvements that have a shelf life of less than one year to your cost basis.

Of course, increasing the cost basis of your home by making improvements only really helps you save money after you sell your home — and only if the profit you earn from the home is more than $250,000, or $500,000 if you are married.

There are improvements you can make that will result it a more immediate tax deduction and money savings. Those improvements include increasing the energy efficiency of your home.

While many of the tax credits available for making energy-efficient improvements to your home expired at the end of 2016, there are a still a few deductions and tax credits available. For example, you can claim a tax credit of up to 30 percent of the cost of installing a solar energy system from 2017 until 2019. If you wait until 2020 to install your system, the credit falls to 26 percent. It falls to 22 percent in 2021 and is phased out entirely by 2022.

If you did make energy efficient upgrades to your home in 2016, you are able to claim them on your tax return, filed by April 18, 2017. You can get up to $500 back when you file your return, as long as the one of the following was completed by December 31, 2016:

- Installed insulation.

- Installed energy efficient exterior doors.

- Installed energy efficient windows.

- Installed energy efficient roof.

- Installed energy efficient central air conditioning, furnace, water pump, boiler, heat pump or biomass stove.

If you installed fuel cells or a residential wind turbine before Dec. 31, 2016, you can get a tax credit for up to 30 percent of the cost of the installation. To claim the credits of your 2016 tax return, you need to complete IRS Form 5695.

Medical Improvements and Tax Deductions

Energy efficient improvements aren’t the only home repairs that can qualify for an immediate tax break. If you had to make any changes to your home to accommodate a health or medical condition, you might be able to deduct those expenses as medical expenses.

First things first, it’s important to understand that not everyone qualifies for the medical expenses deduction. You can deduct expenses that are more than 10 percent of your adjusted gross income (AGI). That means if your AGI is $50,000, you can only deduct medical expenses that exceed $5,000. If you have exactly $5,000 in medical expenses, you can’t take the deduction. If you have $5,500 worth of medical expenses, you can deduct $500.

To claim the deduction, you need to complete Schedule A with your tax return. If you’re claiming the mortgage interest deduction, you’re already filling in Schedule A. If medical expenses are your only itemized deduction and the amount you’re able to deduct isn’t more than your standard deduction, it doesn’t make sense to claim them.

That all said, which home improvements qualify as medical expenses? For starters, the improvements need to have been medically necessary. For example, if a member of your household has mobility issues and difficulty getting up and down stairs, you might install an elevator to help them get to the second floor. Another medically necessary improvement might be installing a ramp to the front door or a bathroom on the first floor. Installing handrails in the shower or bathtub are also usually medically necessary home updates.

If a person in your home has lost their hearing, you might need to install a fire alarm that flashes lights in addition to or instead of making a loud noise. You might need to widen doors or hallways to create enough space for a wheelchair or make changes in the bathroom to help a person who is at risk for falling in the tub or shower.

One more thing that’s worth considering when you make medically necessary changes to your home is that you can only deduct the amount that doesn’t add to the value of your home. Installing ramps and widening doors usually doesn’t increase the value of your home, so you are able to deduct the full cost of those expenses.

But if you install an elevator or completely renovate your bathroom while making it more accessible, you’re able to deduct the cost of the project, minus the amount it increases your home’s value. If a new, accessible bathroom costs $12,500 and increases your home’s value by $10,000, you can deduct $2,500 as a medical expense.

Documenting Home Improvements

Whether the improvements you make to a home mean a reduction in capital gains taxes when you sell or a tax deduction or credit in the current tax year, it’s incredibly important to keep good records of each repair or improvement.

Keep a file with all the receipts for all your home improvement projects. If you are claiming a medical expense deduction for a change you made, it’s also a good idea to get a note from the doctor. The note should demonstrate and explain how the improvement was medically necessary.

It can also be a good idea to get the professional, written opinion of a real estate appraiser when it comes to the value of any improvements you made to the house, especially improvements made for medical reasons. You don’t want to claim the full cost of widening the doors in your home, only to have the IRS argue later on that those wider doors added thousands to the value of your home.

Timing Helps Maximize Your Home Improvement Savings

Tax season isn’t just a good time of year to figure out which home improvement projects can help lower your tax bill. It’s also often a good time of year to start on certain projects, as the cost for many remodeling projects is often lower at certain times of year compared to others.

The remodeling world operates based on supply and demand — just as train fares increase during peak commuting periods or the cost of a plane ticket skyrockets during the holidays. The cost of a renovation project jumps when more people are looking to remodel. It’s not just the cost of labor that goes up. It’s also the cost of supplies.

Often, January, February and March are the best times of year to schedule a remodeling project. Demand for contractors is low during those months, so you are likely to get a better price quote on your project.

If you’re looking to redo your bathroom, for example, you might find that there are a number of sales during the winter months, as showrooms try to clear out last year’s models for the next season’s. Unless you must have the newest of the new or the current season’s styles, you can save a fair amount if you purchase your supplies during the end-of-season sales.

There’s another reason why scheduling your home improvement projects during the slow season makes more sense. Since the companies you’re going to work with won’t be overbooked or over-scheduled, you’re likely to get more care and attention from them. You won’t spend hours or days waiting for someone to get back to you about a concern, nor will you have to worry about the materials you wanted selling out.

Think Carefully to Cut Costs

When it comes to a remodeling project, it’s not just when you schedule the project that influences the cost. It’s also the scope of the project. Let’s take a bathroom renovation project, for example. In 2016, the average cost of a bathroom remodel in the US was $11,364.

Labor costs accounted for about 20 percent of the total average bathroom renovation cost, while installing new fixtures accounted for about 15 percent of the total average cost and installing new flooring made up an average of nine percent of the total cost.

However, it is possible to spend less on your bathroom remodel. Part of spending less involves thinking carefully about the changes you make in the room. For example, leaving fixtures where they are in the room is generally much more affordable than deciding to swap the location of the shower and the toilet. If you decide to move fixtures, you also have to move plumbing, which adds to the price tag considerably.

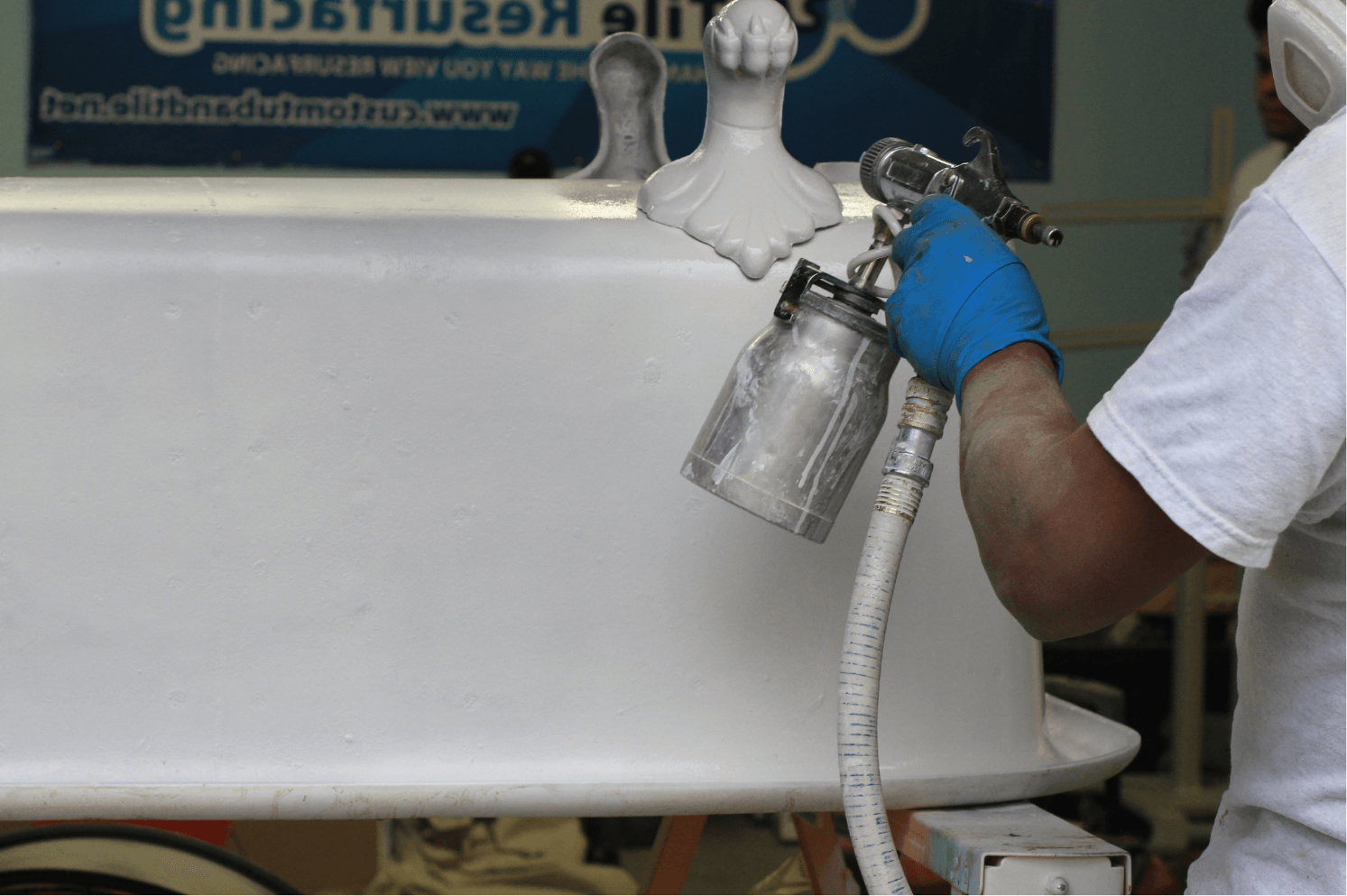

Refinishing fixtures, rather than replacing them, can also trim the cost of a bathroom remodel. The average cost to replace or install a new bathtub is $2,906. Meanwhile, the average cost to refinish an existing bathtub is between $200 and $500. You could save couple thousand dollars if you decide to spruce up your current bathtub with a new glaze instead of replacing it with an entirely new model.

The bathroom isn’t the only room where you can save a considerable amount of money by deciding to resurface rather than replace. For years now, people have been raving about granite countertops in the kitchen.

Granite looks lovely, is durable and is heat resistant. The problem? It’s very expensive. The average cost to install a new granite countertop in your kitchen is around $3,100. The price includes materials and labor.

Another option is to refinish your kitchen countertops, so that you get the look of granite without the high price tag. You can also avoid the mess involved with replacing a countertop if you resurface it instead. Plus, the finished, resurfaced countertop is ready for use much sooner and is easier to care for than a genuine stone counter.

Spending Money to Save Money

There are cases when it makes sense to pay more upfront for a project, so you spend less down the road. If you are adding on to your home, for instance, one area where it makes financial sense to spend more up front is in the purchase of siding.

You can spend up to 20 cents more per square foot for pre-painted and pre-primed clapboard siding. The siding is primed and painted under controlled conditions, so it lasts longer than unpainted siding. The trade-off for you is that you end up having to repaint the siding less frequently. After about 10 years, the higher-priced pre-painted siding can end up saving you more than $1,000.

Small Changes Make a Big Difference

You don’t necessarily have to go big when it comes to improving your home. In some cases, small, inexpensive changes or improves can make a big difference — not only in how you feel about your home, but in the way other people perceive it.

For example, a new coat of paint on the walls can freshen up pretty much any room in your home. If you’re doing it yourself, painting the walls doesn’t have to cost very much at all. For a few hundred dollars, you can make your home look as good as new again.

If you don’t relish the idea of painting a room or two on your own, it’s not particularly cost prohibitive to hire someone else to do it, especially if you hire someone in the off season. The average cost to hire someone to paint a 10 by 12 foot room is between $380 and $790, plus the cost of paint.

Another inexpensive way to improve your home without spending a lot is to take the time to really clear out the clutter or the rid your home of items you don’t need or use. Clearing away the clutter won’t just give you back usable space in your home. It can also help you make a bit of money.

You can sell items you no longer want, either at a yard sale or online. Donating items you no longer want can also mean a tax deduction on your return. If you itemize your deductions and complete Schedule A, you can deduct the fair market value of the items you donate, for a total amount of up to 50 percent of your AGI.

One last small, inexpensive change that can go a long way toward improving your home: replacing the hardware in the kitchen and bathroom. Swapping out tired and outdated cabinet door handles and drawer pulls, worn-out and rusty towel rails, and dingy light switch plates can make a big difference in the overall look of a room. Plus, these changes won’t cost you much at all. You can find new drawer pulls for just a $1 at some hardware stores, for example.

While not all home repairs are tax deductible, there are plenty of ways to save when doing a home improvement project. If you’re considering making the most of tax season and want to explore affordable options for sprucing up your kitchen or bath, contact Custom Tub and Tile Resurfacing today!